Recent Posts

GST 2.0 Reshapes Construction: Lower Costs, Affordable Housing, and Faster Project Delivery

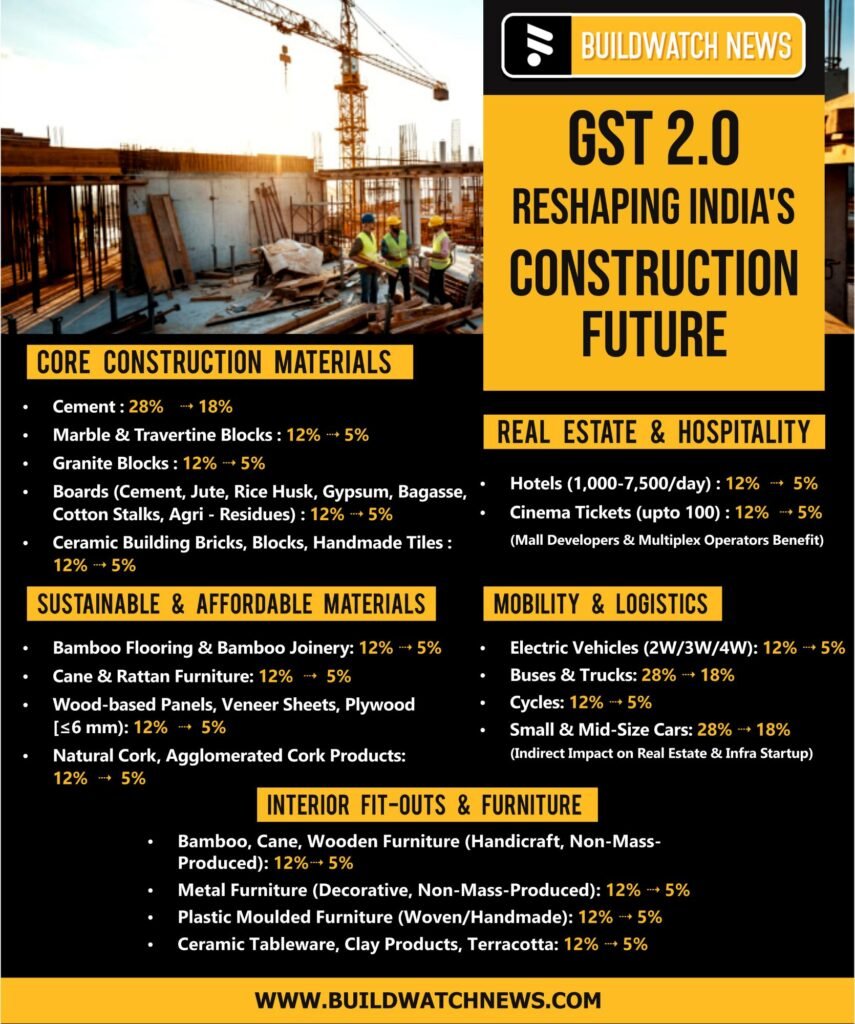

India’s construction sector has entered a new phase of growth following the rollout of GST 2.0 on September 22. The reform has restructured tax slabs across key materials and logistics, providing long-awaited relief for developers, contractors, and homebuilders.

The most notable change is the reduction of GST on cement from 28% to 18%. Cement, which accounts for a major portion of project costs, now comes at a lower tax rate, immediately easing financial pressures across residential, commercial, and infrastructure projects. Industry experts believe this will accelerate housing demand, reduce input costs, and help revive stalled developments.

In addition, several essential materials such as granite blocks, marble, travertine, ceramic tiles, and construction boards have shifted from 12% to 5%. These reductions will directly lower procurement costs for builders, making both urban and rural projects more affordable. Analysts say this structural change will also boost the government’s push for affordable housing schemes by making construction materials accessible at competitive prices.

Sustainability has also been placed at the center of GST 2.0. Eco-friendly products such as bamboo flooring, wood-based panels, and cork materials are now taxed at only 5%, encouraging builders and interior contractors to embrace greener options without inflating project budgets. This aligns with India’s climate commitments while giving a competitive edge to sustainable construction practices.

The reforms extend beyond materials into mobility and logistics, critical enablers for the construction industry. Lower GST rates on buses, trucks, two-wheelers, and small cars reduce logistics and site transport costs. This is expected to streamline material delivery, cut operational overheads, and improve project timelines.

For India’s construction industry, GST 2.0 is not merely a tax adjustment but a growth catalyst. By cutting costs, boosting sustainable materials, and improving supply chains, the reforms position the sector for stronger expansion. As the new regime takes effect, builders and suppliers are already reworking pricing models, ensuring that the benefits of GST 2.0 reach both developers and end consumers in the months ahead.

- GST 2.0

- GST 2.0 affordable housing

- GST 2.0 bamboo flooring

- GST 2.0 Build Watch News

- GST 2.0 builders cost savings

- GST 2.0 building materials

- GST 2.0 cement rate cut

- GST 2.0 construction impact

- GST 2.0 construction industry news

- GST 2.0 developers benefit

- GST 2.0 effect on contractors

- GST 2.0 homebuyers relief

- GST 2.0 housing demand boost

- GST 2.0 housing sector

- GST 2.0 infrastructure growth

- GST 2.0 logistics costs

- GST 2.0 project cost reduction

- GST 2.0 real estate

- GST 2.0 real estate India

- GST 2.0 rollout

- GST 2.0 September rollout

- GST 2.0 sustainable materials

- GST 2.0 tiles and marble

- GST cement 18 percent

- GST reduced building materials

Recent Posts

Categories

- Acquisition1

- Airport16

- AP106

- Apartments128

- Bengaluru219

- Budget 202521

- Cement167

- Chennai440

- Construction919

- Construction Material Price Updates1

- Corporation4

- CREDAI61

- Editors Pick43

- Equipment45

- Events11

- Export25

- GST17

- Highways118

- Hotel16

- Housing210

- Hyderabad98

- import26

- India131

- Industrial392

- Infrastructure625

- Interiors29

- Iron Ore61

- Karnataka93

- Kerala57

- Labour1

- Land153

- Logistics41

- Market Updates411

- Metal103

- Metro109

- Mining80

- MSME22

- News1,889

- NHAI96

- Office Space3

- Paints39

- Port3

- Power Shutdown1

- Properties116

- Puducherry12

- Railways8

- Real Estate769

- Road223

- Sand38

- Short News117

- SIPCOT16

- Steel Daily432

- Stocks40

- Tamil Nadu463

- Technology85

- Telangana100

- TIDCO10

- Trade56

- Trending News1,117

- Video2

- warehouse45

Related Articles

Ennore Fishermen Raise Concerns Over River Blockage as CPRR Construction Debris Alters Water Flow

Fishermen in Ennore say construction debris from the Peripheral Ring Road bridge...

BySamrita JosephDecember 9, 2025Sambhv Steel Tubes Moves to Double Annual Capacity with ₹50 Crore Expansion Plan

Sambhv Steel Tubes has approved a ₹50 crore expansion plan that will...

BySamrita JosephDecember 9, 2025Trump Media Announces Rs 1 Lakh Crore Investment Plan for Telangana’s Bharat Future City

Trump Media and Technology Group has unveiled a massive Rs 1 lakh...

BySamrita JosephDecember 9, 2025India and Sweden Advance Decarbonisation with Seven New Projects in Steel and Cement Sectors

India and Sweden have jointly launched seven decarbonisation projects for the steel...

BySamrita JosephDecember 9, 2025

Leave a comment