Recent Posts

Asian Paints Bets on Innovation Over Price Wars Amid Fierce Market Competition

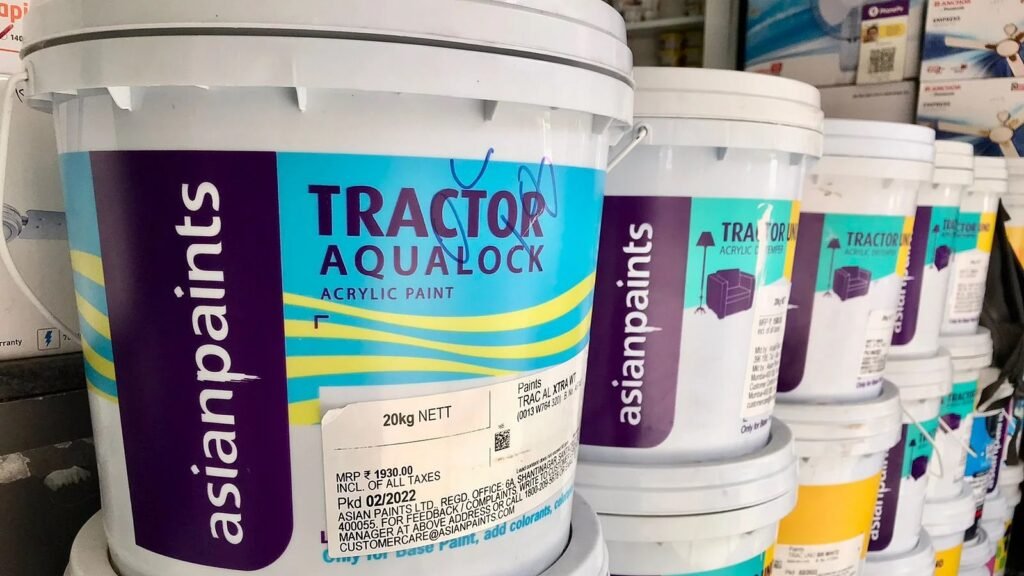

Facing increased competition and a demand slowdown, Asian Paints is refusing to engage in a price war to defend its dominant 54% share in India’s ₹70,000 crore decorative paints market. Instead, the company is doubling down on product innovation, expanding rural reach, and leveraging digital tools.

“FY25 has been one of the worst years for the industry,” admitted Amit Syngle, Managing Director and CEO of Asian Paints, during an analyst call. Yet, he remains cautiously optimistic about FY26, banking on a rural demand revival, monsoon-led recovery, and a pickup in premium and second-home housing segments.

Despite inflationary stress, Asian Paints recorded a standalone EBITDA margin of 18.6% in Q4 FY25, driven by decreasing input costs like titanium dioxide. The Q4 of the company was not up to the mark as the revenue fell 4.3% and net profit came down 45% year-on-year at ₹692.1 crore from ₹1,256.7 crore.

Instead of reducing prices due to the entry of players such as Grasim Industries and JSW Paints, Asian Paints is consolidating its value proposition by banking on quality and endurance. Recently, the company enhanced its product warranties—from four years for interior paint to 25 years for rooftop waterproofing—at no extra cost.

“Warranties are a quality signal. Our chemistry is advanced enough to support them without raising prices,” said Syngle, pointing to internal R&D and backward integration as cost-saving levers.

With 1.69 lakh retail touchpoints, Asian Paints is also accelerating its rural expansion and adopting digital tools such as Salesforce for dealer management. The company is targeting Gen Z customers with its AI-based colour visualization tool, Chromacosm, and over 1,000 in-store colour consultancies.

FY26 capital spend of ₹7,000–8,000 crore will see investments in expanding capacities and upgrading technology—such as a ₹3,000 crore emulsion unit and ₹2,000 crore vinyl acetate monomer plant.

Asian Paints has targeted a low single-digit top-line growth in FY26 while continuing to have a consolidated EBITDA margin guidance of 18–20%. “We’re not here to play the price game,” Syngle asserted. “We’re here to build sustainable value.”

- Amit Syngle

- Asian Paints

- Buildwatchnews

- Chromacosm

- Construction materials

- Decorative Paints

- digital tools

- EBITDA margin

- emulsion plant

- FY25 results

- Gen Z marketing

- Grasim Industries

- Housing Market

- Indian paint industry

- Input Costs

- interior paint

- JSW Paints

- paint market share

- paint technology

- Premium Homes

- rural expansion

- Salesforce

- titanium dioxide

- vinyl acetate monomer

- warranties

- waterproofing paint

Recent Posts

India’s Industrial Output Records Strongest Growth in Over Two Years

January 29, 2026Categories

- Acquisition3

- Airport25

- AP147

- Apartments163

- Architecture1

- Bengaluru271

- Budget3

- Budget 202521

- Cement194

- Chennai499

- Construction1,110

- Construction Material Price Updates1

- Corporation5

- CREDAI69

- Editors Pick43

- Equipment57

- Events12

- Export55

- GST18

- Highways136

- Hotel26

- Housing250

- Hyderabad129

- import59

- India340

- Industrial494

- Infrastructure798

- Interiors32

- Investment124

- Iron Ore90

- Karnataka128

- Kerala71

- Labour12

- Land203

- Leasing3

- Logistics85

- Market Updates631

- Metal158

- Metro121

- Mining109

- MSME23

- News2,125

- NHAI109

- Office Space16

- Paints43

- Port10

- Power Shutdown1

- Properties194

- Puducherry13

- Railways12

- Real Estate947

- Rental3

- Results3

- Road251

- Sand43

- Short News117

- SIPCOT24

- Steel Daily503

- Stocks91

- Tamil Nadu555

- Technology131

- Telangana139

- TIDCO16

- Trade135

- Trending News1,171

- Video2

- warehouse96

Related Articles

Special Purpose Vehicle Formed to Develop Mega Shipbuilding Cluster at Thoothukudi

India’s first mega shipbuilding cluster is set to take shape at Thoothukudi...

BySamrita JosephJanuary 29, 2026India’s Industrial Output Records Strongest Growth in Over Two Years

India’s industrial production posted its fastest growth in more than two years...

BySamrita JosephJanuary 29, 2026L&T Q3 FY26 Results: Profit Dips on One-Time Provision, Revenue and Orders Stay Strong

Larsen and Toubro reported a marginal decline in Q3 FY26 net profit...

BySamrita JosephJanuary 29, 2026NHAI Seeks Bids for Rs 51.27 Crore Tunnel Underpass on Bengaluru Airport Highway

The National Highways Authority of India has invited bids worth Rs 51.27...

BySamrita JosephJanuary 29, 2026

Leave a comment