Recent Posts

Home Sales Drop 14% in Q2 Amid Affordability Woes: PropTiger Report

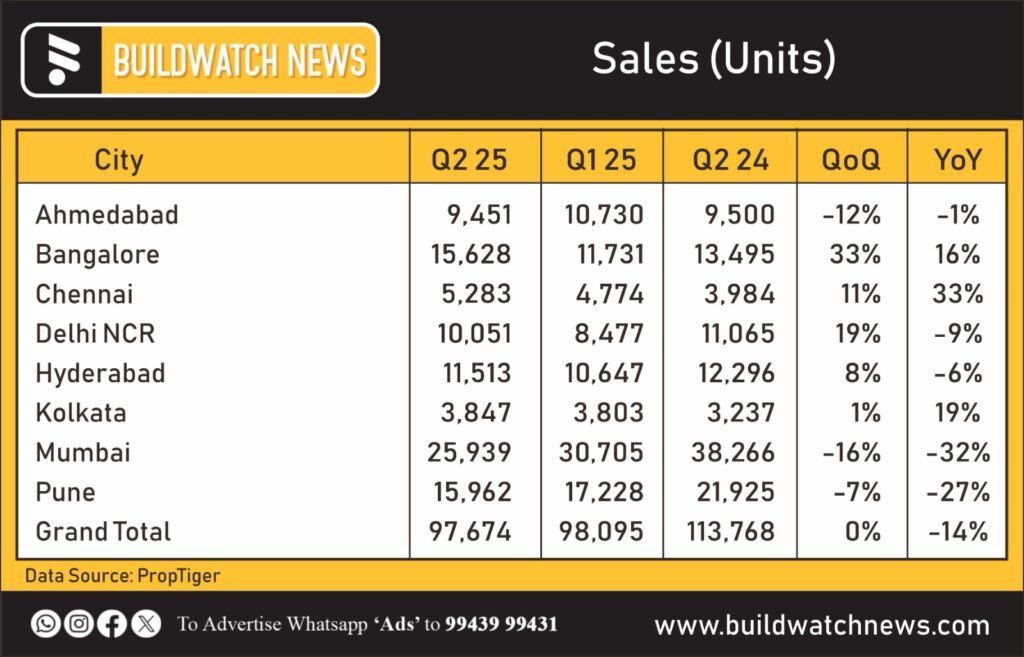

Residential properties in India have witnessed a 14% reduction in sales annually during the April to June 2025 quarter in the PropTiger.com report, titled the Real Insight Residential – April-June 2025, which revealed that soaring prices deterred potential buyers from attempting to step into the market.

However, the effect on this slowing was mainly due to the present affordability issues in the budget and mid-income segments, which witnessed the highest year- on-year sales declines in major metros like Mumbai Metropolitan Region (MMR) and Pune at 32% and 27%, respectively. Bengaluru, Chennai, and Kolkata showed contrary trajectories with positive growth.

On the contrary, total sales remained almost the same compared to Q1 with an annual decline that had pushed up overall sales for the quarter, aside from the notable contributions of MMR (27%), Pune (16%), and Bengaluru (16%), which accounted for almost 60% of transactions.

Sridhar Srinivasan, Head of Sales, PropTiger.com, described the dip as a “recalibration” rather than as an indicator of erosion in demand. According to him, “Challenges with affordability have resulted in some caution, but the underlying demand is good, as indicated by sequential improvements and sustained activity in leading markets.”.

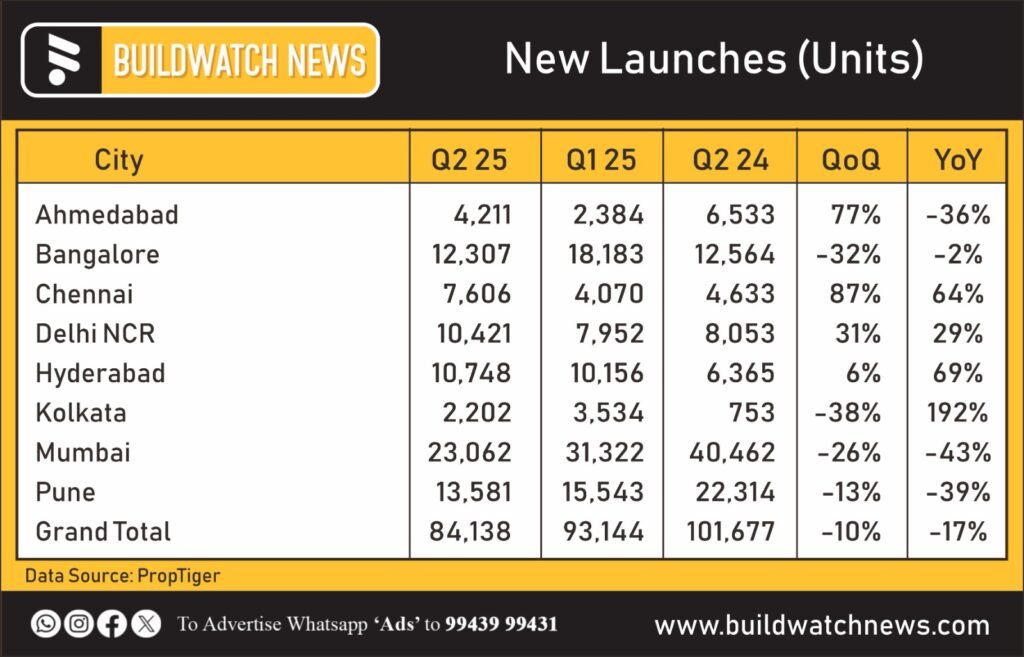

The report also highlighted a decline in new housing supply in the said quarter, which fell on both a year-on-year and quarter-on-quarter basis, partly due to geopolitical uncertainties. Specifically, border tensions between India and Pakistan led to cross-border strikes during Q2, to volatility in the market and developer hesitancy.

City-level trends in new supply diverged considerably. While MMR, Pune, and Ahmedabad shrank in new launches, cities such as Kolkata experienced escalation-nearly tripling launches due to a previously low base.

According to PropTiger, the overall macroeconomics that underpin India remain strong despite the global crisis: “This dip has nothing to do with lack of demand; realism and affordability have been impacted by the sharp spikes in housing prices. Particularly, the affordable housing segment is under stress,” commented the organization.

Interestingly, developers have maintained long-term confidence in the sector, especially in the premium category, reinforced by strategic land acquisitions during H1 2025; a signal that housing aspirations remain strong despite the short-term challenges.

- affordable housing crisis

- affordable vs premium housing India

- April June home sales report

- Bengaluru real estate trends

- Buildwatchnews

- Chennai housing update

- geopolitical impact on housing

- home sales india 2025

- housing market slowdown

- India-Pakistan border tension impact

- Indian housing demand

- Kolkata real estate growth

- land acquisition real estate

- MMR sales drop

- new project launches India

- premium housing segment

- property prices India 2025

- proptiger real insight

- PropTiger.com news

- Pune housing data

- Q2 home sales report

- REA India report

- real estate market India

- real estate supply trends

- real estate trends India

- residential launches India

Recent Posts

Categories

- Acquisition1

- Airport16

- AP103

- Apartments126

- Bengaluru217

- Budget 202521

- Cement165

- Chennai438

- Construction909

- Construction Material Price Updates1

- Corporation4

- CREDAI61

- Editors Pick42

- Equipment45

- Events11

- Export24

- GST17

- Highways118

- Hotel16

- Housing207

- Hyderabad94

- import26

- India122

- Industrial387

- Infrastructure616

- Interiors28

- Iron Ore59

- Karnataka92

- Kerala56

- Labour1

- Land150

- Logistics40

- Market Updates404

- Metal100

- Metro109

- Mining77

- MSME21

- News1,877

- NHAI96

- Office Space2

- Paints39

- Port1

- Power Shutdown1

- Properties112

- Puducherry12

- Railways8

- Real Estate762

- Road222

- Sand38

- Short News117

- SIPCOT14

- Steel Daily429

- Stocks37

- Tamil Nadu458

- Technology81

- Telangana96

- TIDCO9

- Trade52

- Trending News1,111

- Video2

- warehouse42

Related Articles

Modulus Housing Secures ₹70 Crore Funding to Accelerate Market Expansion and Technology Innovation

IIT Madras-incubated Modulus Housing has secured about ₹70 crore in Series A...

BySamrita JosephDecember 6, 2025JPMorgan Expands Its India GCC Presence with Major Office Lease in Hyderabad

JPMorgan Chase has strengthened its India footprint by leasing 1.76 lakh sq...

BySamrita JosephDecember 6, 2025RBI Rate Cut Brings Timely Relief and Boosts Confidence Across India’s Housing Market

The RBI’s rate cut has lifted market sentiment and improved affordability for...

BySamrita JosephDecember 6, 2025JSW Cement Unveils ₹11000 Crore Expansion Plan to Boost Production Capacity to 41 Million Tonnes

JSW Cement has announced a major ₹11000 crore expansion plan to increase...

BySamrita JosephDecember 6, 2025

Leave a comment